Has the Game Changed in 2021?

Author: Patrick Blair

A sensible person sees danger and takes cover,

but the inexperienced keep going and are punished. (Proverbs 22:3 HCSB)

In 2020, many of our basic assumptions about the world have been challenged. The year brought socio-political and financial shocks, partly caused by society’s response to COVID-19. Here are some of the financial game changers:

1) Millions have lost their jobs and are relying on public assistance. Many retail, service, and hospitality jobs appear to have been permanently eliminated.

2) The government is implementing so-called “Modern Monetary Theory” through its stimulus efforts (direct payments, PPP, unemployment enhancement, etc.). Stimulus is likely to continue in one form or another and may eventually become constant.

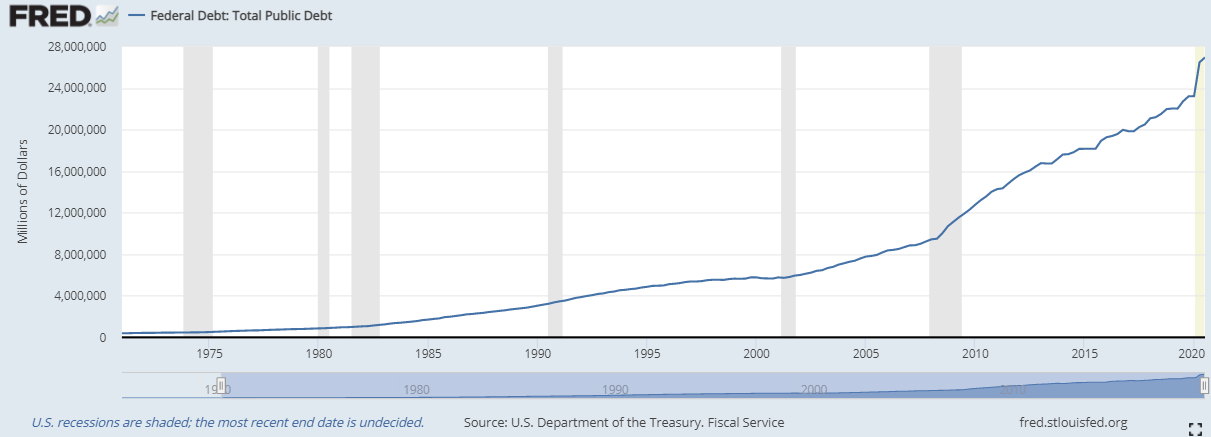

3) Government debt has gone parabolic and the Federal Reserve is the only buyer of that debt. The government and central bank will not be able successfully backstop the economy for too long.

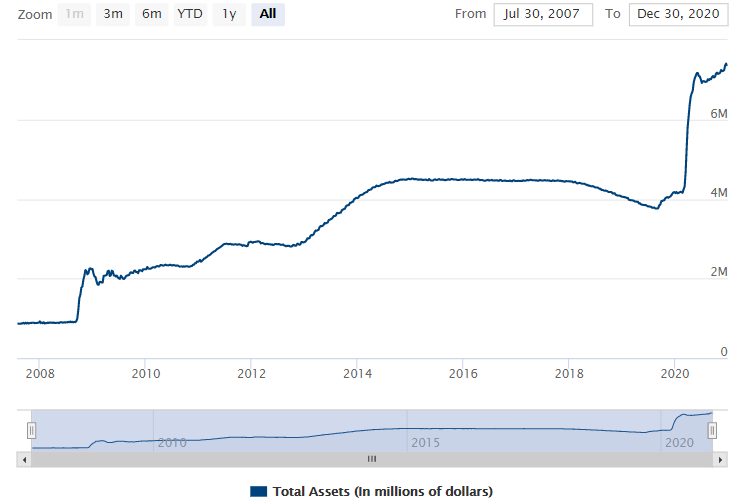

4) It has become abundantly clear that Wall Street bears little relationship to Main Street. Price to earnings ratios are reaching extreme levels. At this point, the stock market appears to be driven solely by central bank money printing and asset purchases.

Federal Reserve Holdings (Balance Sheet)

5) With record low interest rates and supply issues, housing prices are rapidly rising, and the gains are shifting toward suburban and rural areas. COVID has untethered many from their workplaces allowing them to move from cities to more desirable, lower-cost locations. This shift along with changing consumer habits has caused commercial real estate to suffer.

6) Small businesses have suffered, especially restaurants and retail. Owning these types of small business has become riskier that it already was.

7) More people are living paycheck to paycheck. Survey Reveals Spending Habits During COVID-19 | Highland (highlandsolutions.com) “Respondent’s emergency savings have also taken a hit since the pandemic. … [I]f they were faced with a surprise $500 expense, 82% say they would not be able to afford it.”

8) Alternative investments like bitcoin (+400%) and gold (+25%) have soared in 2020, signaling dollar weakness.

While there are always economic fluctuations, the speed of these recent changes is alarming. The Bible says not to worry, but rather to prepare with wisdom and humility. To learn more, please read my book Faith and Finances. Also, check out this promotional video for my new church course: Building Faith and Finances.