Younger Generations: Keep Your Heads Up

Author: Patrick Blair

Every generation has its challenges, financial and otherwise. The stereotype is that Boomers had it easy and have been ruining everything for everyone, yet many are facing retirement with very little. Gen X is said to be the “sandwich generation” taking care of kids and parents simultaneously; so much for being rugged individualists!

Millennials (1981-1996) have been cast as entitled and lazy. Gen Z (1997-2012) are perceived as distracted by technology and uncommitted. Younger generations always get a bad rap, because their parents and employers reflexively apply outdated standards. There’s no need to vilify anyone, because people are just people; each generation simply reflects their upbringing and responds to the unique set of challenges before them.

Are Things Really Harder for Younger Generations?

Yes and no. We’ve never had such convenience, technology, and access to information. Higher education is more accessible than ever before, but a college degree’s value is diminishing. There are endless career possibilities and amazing entrepreneurial opportunities everywhere, but school debt, inflation, and stagnant wages have made financial success elusive for most.

As of January 2026, the job market is deteriorating, especially for new college graduates (though the job market for many of the trades is booming). School debt, credit card debt, and bankruptcies are at all-time highs. Inflation is persistent and sticky. It seems that only those with significant assets can get ahead these days. For younger people, the elephant in the room is home affordability.

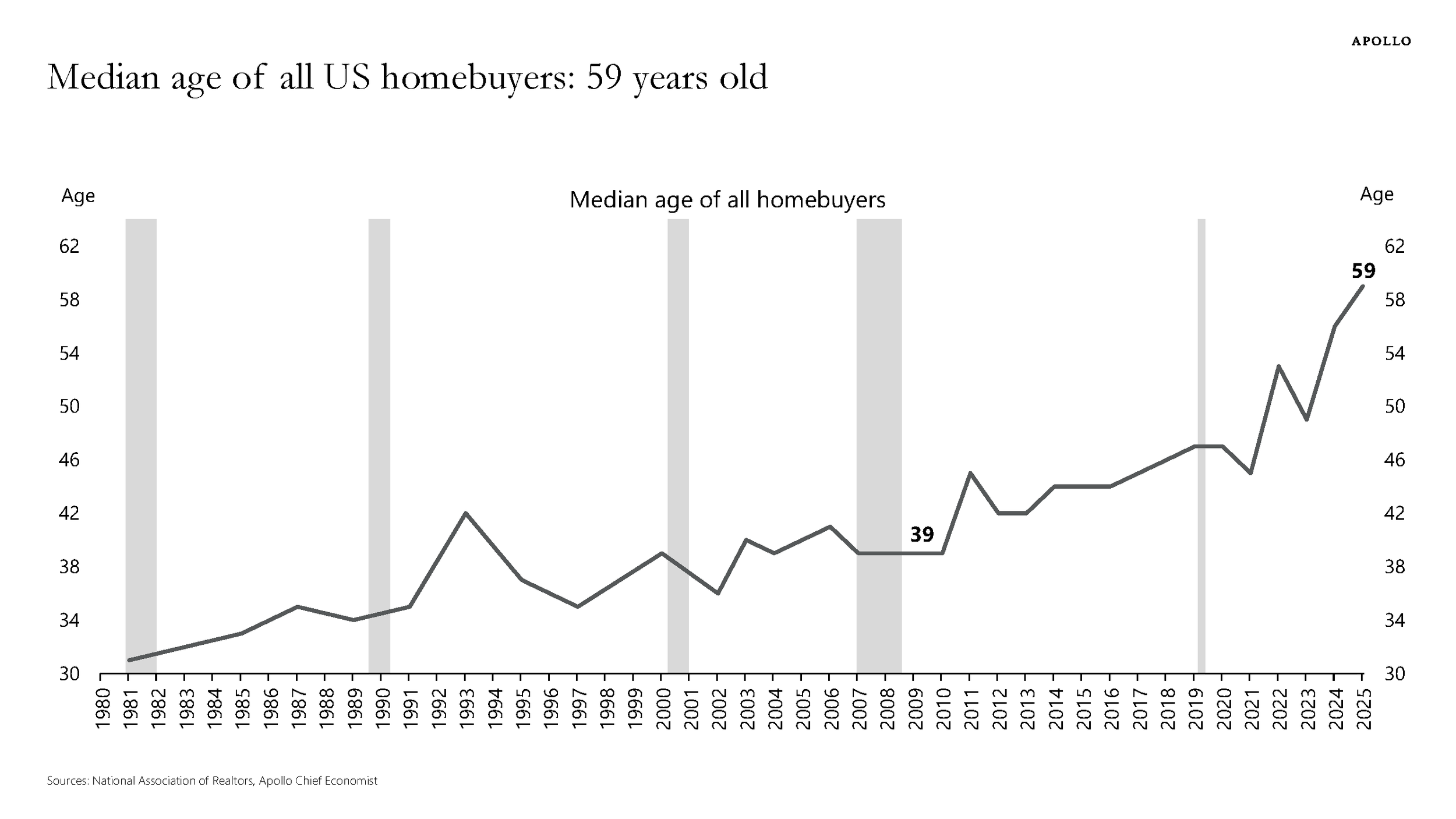

In 2010, the average age of homebuyers was 39, which seems about right. Late 20 somethings and people in their 30s bought houses and started families. Now, the average age of homebuyers is a grey-haired 59! The market is now limited to older, wealthy people swapping houses with each other.

Younger couples want to settle down, buy a home, and have children. But they are discouraged and insecure because they don’t feel they can support a family. Some have given up on building wealth and have adopted a YOLO spending mentality, which is a symptom of giving up on “the system” and “the American Dream”.

Stick With Biblical Principles (It Is Always Darkest Before the Dawn)

Forget the American Dream and stick with biblical principles! Young people: don’t give up and don’t be discouraged! No matter your generation, there will always be setbacks and hardships; pray, embrace discipline, dig deep, and prosperity will come in time. “Consider it pure joy, my brothers and sisters, whenever you face trials of many kinds, because you know that the testing of your faith produces perseverance. Let perseverance finish its work so that you may be mature and complete, not lacking anything.” James 1:2-4.

I went through personal hardships with job loss and debt (see Chapter 3 of the Faith and Finances book). The hardships were an opportunity to persevere, be refined by God, and grow. In the long run, your character is what counts. A good character will pave the way to righteousness and prosperity. “All hard work brings a profit, but mere talk leads only to poverty.” Proverbs 14:23. God wants us to work hard even if it doesn’t seem like it is getting us ahead at the moment. We should work our jobs and businesses as if working for the Lord. Colossians 3:23.

“Dishonest money dwindles away, but whoever gathers money little by little makes it grow.” Proverbs 13:11. Avoid instant gratification and YOLO spending (e.g., food, gadgets, vacations you can’t afford). Rather, make sure you are saving and investing little by little (e.g., regular, automatic contributions to your emergency fund, 401k/IRA, and precious metals). Life lasts much longer than your next “experience” or impulse purchase.

“Sow your seed in the morning, and at evening let your hands not be idle, for you do not know which will succeed, whether this or that, or whether both will do equally well.” Ecclesiastes 11:6. If you don’t invest with hard work and financial investments, you cannot succeed. With every financial challenge, there is always opportunity.

Inflation diminishes debt burdens and brings higher wages. Higher interest rates eventually bring home prices down. Technology creates jobs that younger generations are well-suited for. Corporate bankruptcies clear the market for new companies that you could start, be a part of, or invest in. Opportunities are always around the corner.

For further study, here is a list of Scriptures on various topics. For a broader spiritual view on hard work, saving, investing, and other topics, read Faith and Finances or do the Building Faith and Finances course.